Repository

🚨 TECH BLOODBATH INTENSIFIES: Amazon's $200B AI Gamble Triggers Market-Wide Selloff | Bitcoin Crashes Below $65K

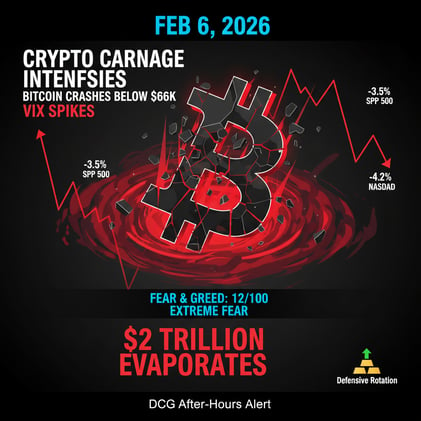

Friday, February 6, 2026 - DCG COMMAND CENTER Pre-Market Intelligence Report |Your Complete Pre-Market Battle Plan for Friday Trading - Fifth Consecutive Down Day Creates Historic Buying Opportunity

🚨 BREAKING: Bitcoin Crashes Below $70K as Tech Rout Intensifies - Critical Trading Levels for Thursday's Session 📉

DCG COMMAND CENTER | Market Intelligence Report |Thursday, February 5, 2026 | Pre-Market Analysis |URGENT MARKET UPDATE: Bitcoin plunges to 16-month lows • Silver crashes 16% • Alphabet disappoints on capex guidance • Memory shortage hits chip stocks