- Stocks, Options, and Crypto, AI-Powered Market Insights

- Archive

- Page -15

Repository

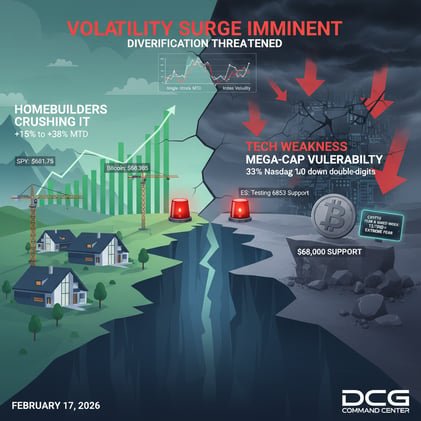

MARKETS BRACE AS BITCOIN CRASHES BELOW $63K, S&P FUTURES HOLD 6,862 — Home Depot BEATS, AI Arms Race Ignites & Fed Speaks: Your Complete February 24 Trading Game Plan

Crypto Fear & Greed Hits 11 (Extreme Fear) | HD +15 Pre-Market | CRWD Releases AI Threat Report | INTC SN50 Chip 5X Speed | Gold Eyes $6,200 — What Traders Must Know Before The Bell

🚨 TRUMP FIRES 15% GLOBAL TARIFF MISSILE — NVDA EARNINGS WEEK BEGINS, GOLD EXPLODES TO $5,182 & NVO CRATERS 15%

🔴 BREAKING: Trump raises global tariffs to 15% — EU freezes US trade deal — Bitcoin plunges below $65K — Gold $5,182 (+2%) — Silver +5% — NVO -15% — NVDA earnings Wed Feb 25 AH — GOOGL upgraded to Overweight at Wells Fargo