- Stocks, Options, and Crypto, AI-Powered Market Insights

- Posts

- 🚀 GOVERNMENT SHUTDOWN ENDS: MARKETS EXPLODE HIGHER AS SENATE BREAKS 40-DAY STALEMATE

🚀 GOVERNMENT SHUTDOWN ENDS: MARKETS EXPLODE HIGHER AS SENATE BREAKS 40-DAY STALEMATE

DCG COMMAND CENTER TRADING NEWSLETTER------Tuesday, November 11, 2025 | Veterans Day Trading Session

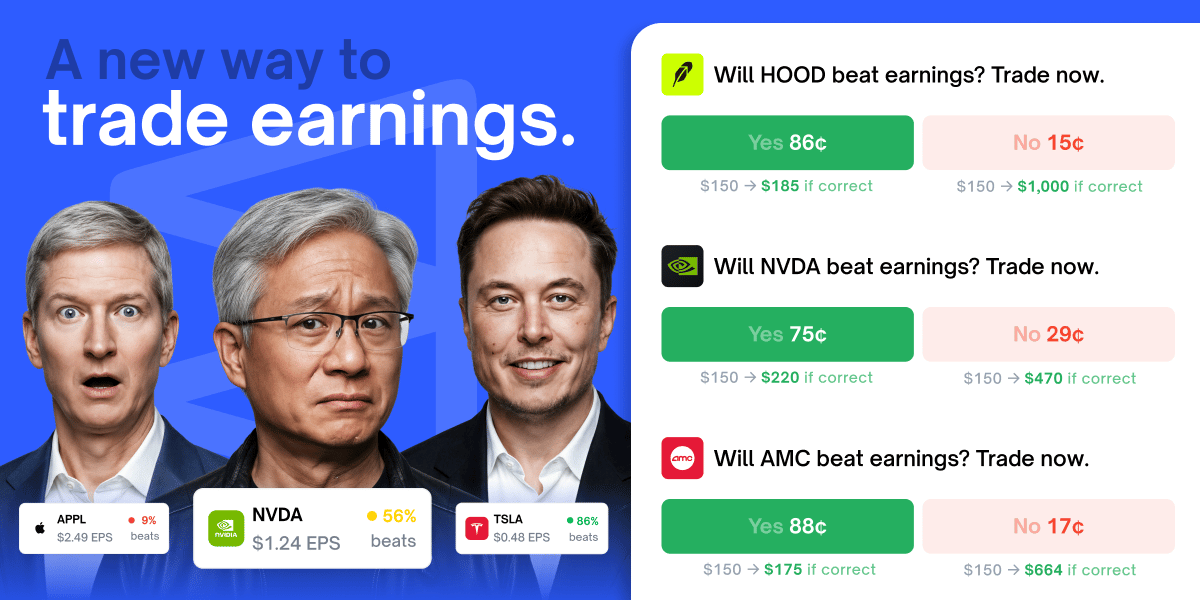

Breaking: Earning Markets are now LIVE on Polymarket 🚨

Turn a question into profit in one click with Polymarket’s new Earnings Markets. You can now trade yes/no on outcomes of your favorite companies:

Will Robinhood beat earnings?

Will Nvidia mention China?

Will Figma miss estimated EPS?

Earning Markets allow you to:

Trade simple Yes/No binary outcomes around earnings

Stay focused and isolate the specific event you want to trade

Be flexible with with entering, hedging, or exiting your position at any time

Upcoming markets include FIGMA, ROBINHOOD, AMC, NVIDIA, and more. Built for how traders actually trade.

📊 Relief Rally Sparks Major Market Reversal After Historic Government Shutdown Resolution

⚡ KEY TAKEAWAYS FOR TODAY'S SESSION

BREAKING: Senate passes bill 60-40 to end longest shutdown in U.S. history (40 days). House vote expected Wednesday at 4PM ET. Markets surge on liquidity restoration and political stability.

💰 VERIFIED CLOSING PRICES (November 10, 2025):

SPY: $681.44 (+1.56% / +$10.47) - S&P 500 Index closed at 6,837.75

NVDA: $199.05 (+5.79% / +$10.90)

BTC: $104,341 (+0.87% / +$913)

CRWV: $105.61 (+1.54%) - Down from $110.70 intraday high

NBIS: $109.95 (-1.20%) - Earnings catalyst pending

🔥 TODAY'S TRADING FOCUS:

Government reopening relief rally continuation

AI infrastructure shake-up (CRWV guidance miss, NBIS Meta deal)

Sea Limited (SE) earnings report before open

Bitcoin consolidation above $105K support

Sector rotation into cyclicals and defensives

📈 MARKET SENTIMENT OVERVIEW

BULLISH CATALYSTS ✅

Government Shutdown Resolution - MAJOR CATALYST

Senate advanced bill 60-40 with 8 Democrats crossing aisle, markets rallied immediately on liquidity restoration hopes

Federal workers to receive back pay, services resume

Economic data releases restart (CPI, jobs reports delayed)

S&P 500, Dow Jones, and Nasdaq surged on November 10 as Senate breakthrough ignited wave of optimism

AI Infrastructure Mega-Deals

NBIS signs $3B agreement with Meta over 5 years for AI infrastructure delivery

Microsoft $17.4B-$19.4B GPU deal with NBIS (5-year commitment)

NBIS believes it can achieve annualized run-rate revenue of $7-9B by end of 2026

OpenAI and Meta driving demand for GPU infrastructure

Crypto Market Strength

Bitcoin surged 4.48% in last 24 hours, trimming weekly losses after bouncing off $102K Fibonacci support

Ethereum delivered 6.48% gain, outperforming BTC and trading around $3,617

Strive acquired 1,567 BTC for $162M at $103,315 average, bringing total holdings to 7,525 BTC

BEARISH HEADWINDS ⚠️

AI Infrastructure Reality Check

CoreWeave (CRWV) delivered disappointing full-year guidance of $5.05B-$5.15B vs $5.29B consensus

Third-party data center developer behind schedule, CEO noted one data center impacting delivery

Multiple analyst downgrades: JPMorgan to Neutral ($110 PT), Mizuho to Neutral ($120 PT)

CRWV down -37% from October rebound high

Big Tech Exits

SoftBank sold entire 32.1M NVDA stake for $5.83B in October

Meta Chief AI Scientist Yann LeCun plans to exit company to launch own AI startup

Intel's AI chief Sachin Katti jumps ship to OpenAI

Economic Concerns

Goldman Sachs Job Growth Tracker slowed to 50K in October, estimating official nonfarm payrolls show decline of 50K due to government's deferred resignation program

GS Layoff Tracker at highest level in about 14 years

NFIB Small Business Optimism Index fell to 98.2 from 98.8 (forecast 98.3)

🎯 HIGH-CONVICTION TRADING IDEAS

TIER 1: IMMEDIATE ACTION TRADES ⭐⭐⭐⭐⭐

1. NBIS (Nebius Group) - AI Infrastructure Play

Rating: 9.5/10 - STRONG BUY

Entry Zone: $108-$112 (current: $109.95) Targets:

T1: $120 (+9.1%)

T2: $130 (+18.2%)

T3: $143 (+30.1%) Stop Loss: $102 (-7.2%)

Catalyst Analysis:

$3B Meta deal over 5 years for AI infrastructure

$17.4B-$19.4B Microsoft GPU agreement locked in

Q3 revenue $146.1M with guidance for $7-9B ARR by end 2026

CICC initiates coverage at Outperform with $143 price target

Trade Strategy: Scale in on any dip below $110. Major winner in AI infrastructure with better execution than CRWV. Meta deal validates business model. ATM equity program provides growth financing flexibility.

Risk Factors: High volatility (9.43% daily average), capital-intensive business model, potential dilution from ATM program

2. SPY/QQQ - Relief Rally Momentum

Rating: 8.5/10 - BUY

Entry: SPY $678-$682 (current: $681.44) Targets:

T1: $690 (+1.3%)

T2: $700 (+2.7%)

T3: $710 (+4.2%) Stop: $675 (-0.9%)

Catalyst Analysis:

Government shutdown resolution restores market liquidity and removes political overhang

Tom Lee expects year-end performance chase as SPX aims for third-straight 20% annual gain

Economic data releases resuming provides clarity for business decision-making

Trade Strategy: Core long position for relief rally. Government reopening removes major uncertainty. Fund managers underperforming need to chase into year-end. Watch for $690 breakout.

3. SE (Sea Limited) - Earnings Catalyst Play

Rating: 8.0/10 - SPECULATIVE BUY

Entry Zone: $150-$156 (current: $155.05) Targets:

T1: $165 (+6.4%)

T2: $180 (+16.1%)

T3: $200 (+29.0%) Stop Loss: $145 (-6.5%)

Catalyst Analysis:

Q3 earnings report Tuesday before open

Consensus: $0.59 EPS vs $0.75 expected, Revenue $5.99B vs $5.97B expected

SE raises FY25 Shopee GMV growth to >25% from prior 20%, affirms Garena bookings >30% YoY

E-commerce GMV $32.2B (+28.4% YoY), Adj EBITDA $874.3M vs $521.3M YoY

Trade Strategy: High-risk earnings play. Beat on revenue with raised guidance could spark 10-15% move. Shopee momentum in Southeast Asia and Brazil driving growth. SeaMoney expansion providing upside.

Risk Factors: History of missing estimates (4 straight quarters), competition from TikTok Shop and MercadoLibre, stock down 17.5% pre-earnings

TIER 2: SWING TRADE OPPORTUNITIES ⭐⭐⭐⭐

4. RKLB (Rocket Lab) - Space Infrastructure

Rating: 7.5/10 - BUY

Entry: $50-$52 (current: $51.90) Targets:

T1: $56 (+7.9%)

T2: $62 (+19.5%) Stop: $48 (-7.5%)

Catalyst Analysis:

Q3 loss of $0.03 per share beat consensus of $0.10 loss by $0.07

Revenues rose 48% YoY to $155.08M vs $151.8M consensus

Guides Q4 revenues in-line with expectations

Government space contracts resuming post-shutdown

Trade Strategy: Strong execution in growing space economy. Government reopening unlocks contract awards. Cleanly beat earnings with revenue growth accelerating.

5. HOOD (Robinhood Markets) - Fintech Recovery

Rating: 7.0/10 - BUY

Entry: $160-$170 Target: $179 (+5-11%) Stop: $155

Catalyst Analysis:

President Capital upgrades to Buy from Neutral, raises PT to $179 from $162

Crypto trading volume increasing with BTC above $105K

Government shutdown end supports market activity recovery

TIER 3: AVOID/SHORT CANDIDATES ⭐

6. CRWV (CoreWeave) - DOWNGRADE TO HOLD

Rating: 4.0/10 - AVOID

Analysis:

Guidance miss with FY25 revenue $5.05B-$5.15B vs $5.29B consensus trails badly

Third-party data center developer delays impacting delivery timeline

Multiple downgrades: BAC to $140, Jefferies to $155, Mizuho to $120

Second consecutive quarter of earnings miss

Down -37% from October high, broken ascending trend

Current Price: $105.61 Resistance: $115-$120 (former support turned resistance) Support: $95-$100 (next major support zone)

Strategy: Wait for capitulation and technical reset. Avoid until clear bottoming pattern emerges around $95-$100 zone. Supply chain issues need resolution before re-entry.

💎 BITCOIN & CRYPTO ANALYSIS

Bitcoin (BTC) - Consolidation Above Key Support

Current Price: $105,472 24h Change: +0.87% (+$913)

Technical Levels:

Critical Support: $102,000 (78.6% Fibonacci retracement)

Immediate Resistance: $107,588

Major Resistance: $109,208 → $112,188

Ultimate Target: $126,210 (All-time high from October 6)

Analysis: BTC bounced off $102K Fibonacci support with volume exploding 35.76% to $67.69B. 4-hour chart shows reclaim of $105K support with rally above middle Bollinger Band. RSI rose sharply above 65 reflecting renewed buying interest.

Key Pattern: Price made false breakout of local resistance at $106,482, if daily bar closes far from it, correction to $105K possible

Trading Strategy:

Bulls: Accumulate $103K-$105K for run to $110K+

Bears: Wait for break below $102K for short entries

Range Traders: Sideways $105K-$108K likely near-term

Institutional Flow:

Strive (Vivek Ramaswamy) acquired 1,567 BTC for $162M, bringing holdings to 7,525 BTC following Nasdaq listing

Digital assets saw $1.17B outflows last week led by Bitcoin and Ethereum

Ethereum (ETH) - Outperforming BTC

Current Price: $3,617 24h Change: +6.48%

Levels:

Support: $3,531 → $3,438

Resistance: $3,651 → $3,803

Target: $3,680-$3,800

ETH breaking above $3,531 resistance and touching $3,656 intraday high, just above critical $3,651 barrier. Chart shows strong bullish engulfing candle with RSI at 62.98. Price inside upper Bollinger Band suggesting sustained buying.

Trade: Look for hold above $3,651 for continuation to $3,800. Failure means retest of $3,438.

🏢 SECTOR ROTATION ANALYSIS

MONEY FLOWING INTO:

1. Technology (Leading) 📱

Strength: +2.56% (highest sector performance)

Catalysts: AI infrastructure deals, government reopening supporting tech spending

Top Performers: NVDA (+5.79%), NBIS (Meta deal), AI infrastructure

Play: Continue overweight tech exposure

2. Consumer Discretionary 🛍️

Strength: +1.31%

Catalysts: Holiday season approaching, consumer confidence stabilizing

Play: Accumulate on dips

3. Communication Services 📡

Strength: +1.04%

Catalysts: SE earnings, digital advertising recovery

Play: Selective long positions

MONEY FLOWING OUT OF:

1. Real Estate 🏠

Weakness: -0.07%

Headwind: Interest rate uncertainty

2. Consumer Staples 🥫

Weakness: -0.37%

Headwind: Defensive rotation ending

3. Utilities ⚡

Weakness: -0.03%

Headwind: Risk-on sentiment returning

🎲 FUTURES & KEY LEVELS

S&P 500 E-mini Futures ($ES)

Current: 6,837.75 Overnight: -19.00 (-0.28%)

Critical Levels:

Resistance: 6,900 → 6,920 (ATH)

Support: 6,800 → 6,760 → 6,720

200-Day MA: 6,580

50-Day MA: 6,735

Strategy:

Bulls: Defend 6,800. Break above 6,850 targets new ATH

Bears: Watch for rejection at 6,850-6,900

Key: Close above 6,840 confirms relief rally continuation

📰 BREAKING NEWS IMPACT

WHITE HOUSE & POLITICAL DEVELOPMENTS

Government Shutdown Resolution:

Senate passed bill 60-40 Monday night to fund federal government through January, ending longest shutdown in U.S. history

House could start voting as early as 4PM Wednesday, multiple votes expected

Trump said Monday he supports funding deal negotiated between Republicans and moderate Senate Democrats

Market Impact:

Immediate: Relief rally as political uncertainty removed

Short-term: Economic data releases resume, providing market clarity

Medium-term: Federal spending restarts, supporting cyclical sectors

Healthcare Subsidy Debate:

ACA premium tax credits extension deferred to December vote

Health insurers CI -1.7%, HUM -2.0% on uncertainty

Separate vote required by mid-December

TRUMP ADMINISTRATION STATEMENTS

Tariff Developments:

Trump: "Will figure something out if SCOTUS rules against tariffs"

GS expects IEEPA tariffs ruling December 2025 or January 2026, if blocked could take months to refund $115-145B collected

Swiss close to sealing tariff deal with U.S. for 15% tariffs, could be sealed Thursday or Friday

Economic Policy:

Treasury Secretary Bessent: "Inherited an affordability crisis"

Bessent: "Gigantic drop in mortgage rates"

Bessent: "Can see substantial job growth from AI investments"

Market Implications: Tariff resolution timeline provides clarity. Lower rates supporting housing and consumer spending.

🌍 GLOBAL DEVELOPMENTS

CHINA

PBOC dismisses loan slowdown concerns, framing it as normal part of economy's shift away from traditional growth drivers

PBOC pledges to maintain "relatively loose" financing conditions and strengthen credit support

Property sector declining influence contributes to slower loan expansion

EUROPE

Google to invest around $6B in Germany

Microsoft will spend $10B on AI data center in Portugal

Vodafone delivers strong H1 FY26 results, revenue up 7.3% to €19.6B

HSBC appoints Wei Sun Christianson to board for Asia expansion

AUSTRALIA

Australia Consumer Confidence best since late 2021

Market Impact: Global AI infrastructure buildout accelerating. European telecom strength signals economic resilience.

🔮 TRUMP MOMENTUM TRADES

Trump-Aligned Opportunities

1. Energy & Infrastructure

Government reopening unlocks infrastructure spending

Traditional energy policy supportive

2. Crypto-Friendly Policy

Bitcoin holding $105K with institutional accumulation

Regulatory clarity expected under Trump administration

3. Defense & Aerospace

RKLB benefiting from space program priorities

Government contracts resuming

4. Financial Services

Deregulation theme intact

HOOD upgraded on fintech opportunity

📊 EARNINGS CALENDAR HIGHLIGHTS

THIS WEEK'S KEY REPORTS:

Tuesday, November 11:

SE (Sea Limited) - Before open

Consensus: EPS $0.59, Revenue $5.99B

Company raised FY25 guidance

Watch for Shopee GMV growth, SeaMoney expansion

Wednesday, November 12:

House vote on shutdown bill (4PM ET)

Multiple retailers report

Thursday, November 13:

Tech sector earnings continue

Initial jobless claims (delayed data)

Upcoming Week:

NVDA earnings November 19 - Major catalyst for AI sector

⚠️ RISK MANAGEMENT GUIDELINES

Position Sizing:

High Conviction (Tier 1): 3-5% per position

Medium Conviction (Tier 2): 2-3% per position

Speculative (Tier 3): 1-2% per position

Stop Loss Discipline:

Honor all stops - no exceptions

Move stops to breakeven after +5% gain

Trail stops on winning positions

Portfolio Allocation:

60% Long equity exposure (relief rally play)

20% Crypto (BTC/ETH above support)

10% Options strategies

10% Cash (for opportunities)

🎓 EDUCATIONAL RESOURCES

Want to master momentum trading strategies like the DCG Command Center team?

Join AITradingSkool.com for:

Live trading room sessions

Real-time trade alerts

Technical analysis training

Risk management frameworks

Community of active traders

Learn from traders who execute real trades every day - not just theory.

📝 CLOSING SUMMARY

Bottom Line:

The government shutdown resolution is the dominant catalyst driving Tuesday's session. After 40 days of uncertainty, political stability returns alongside market liquidity. This sets up a classic relief rally into year-end.

Three Primary Themes:

Relief Rally Momentum: SPY targeting $690-$700 as shutdown overhang lifts

AI Infrastructure Shake-Up: NBIS winning (Meta/$3B deal) vs CRWV losing (guidance miss)

Crypto Consolidation: BTC holding $105K support, ETH outperforming with $3,800 target

Actionable Focus:

Core Longs: SPY, NBIS, QQQ (relief rally plays)

Tactical Longs: SE (earnings), RKLB (government reopening), HOOD (fintech recovery)

Crypto: BTC $103K-$105K accumulation zone

Avoid: CRWV until technical reset, health insurers (ACA uncertainty)

Risk Factors:

House vote Wednesday could introduce volatility

Economic data releases may surprise (delayed reports)

AI infrastructure valuations stretched

Year-end tax loss selling pressure

Market Conditions: Favorable for bulls with government reopening, but remain nimble. Use tight stops. Don't chase extended moves. Let the market come to you.

🚀 TRADE WHAT YOU SEE, NOT WHAT YOU THINK

The DCG Command Center team focuses on actionable price action and confirmed catalysts. We don't predict - we react to what the market shows us with disciplined risk management.

Key Principles:

Price action > predictions

Risk management > being right

Execution > emotion

Community > isolation

📅 Tomorrow's Watch List:

SE earnings reaction

SPY break above $690

NBIS follow-through on Meta deal

BTC $107K breakout attempt

Sector rotation continuation

Prepared by the DCG COMMAND CENTER Trading Team Real traders. Real results. Real community.

DISCLAIMER: This newsletter is for educational and informational purposes only. All trading involves risk. Past performance does not guarantee future results. Always conduct your own due diligence and consult with a financial advisor before making investment decisions. Prices and data verified as of market close November 10, 2025.

#MomentumTrading #DayTrading #SwingTrading #AI #Crypto #StockMarket #TradingCommunity #DCG

Reply