- Stocks, Options, and Crypto, AI-Powered Market Insights

- Posts

- 🚀 DOW BREAKS 49,000: Memory & AI Sectors

🚀 DOW BREAKS 49,000: Memory & AI Sectors

IGNITE as Markets Hit Records While Employment Data Softens |DCG COMMAND CENTER | Wednesday, January 7, 2026 Trading Week

When AI Outperforms the S&P 500 by 28.5%

Did you catch these stocks?

Robinhood is up over 220% year to date.

Seagate is up 198.25% year to date.

Palantir is up 139.17% this year.

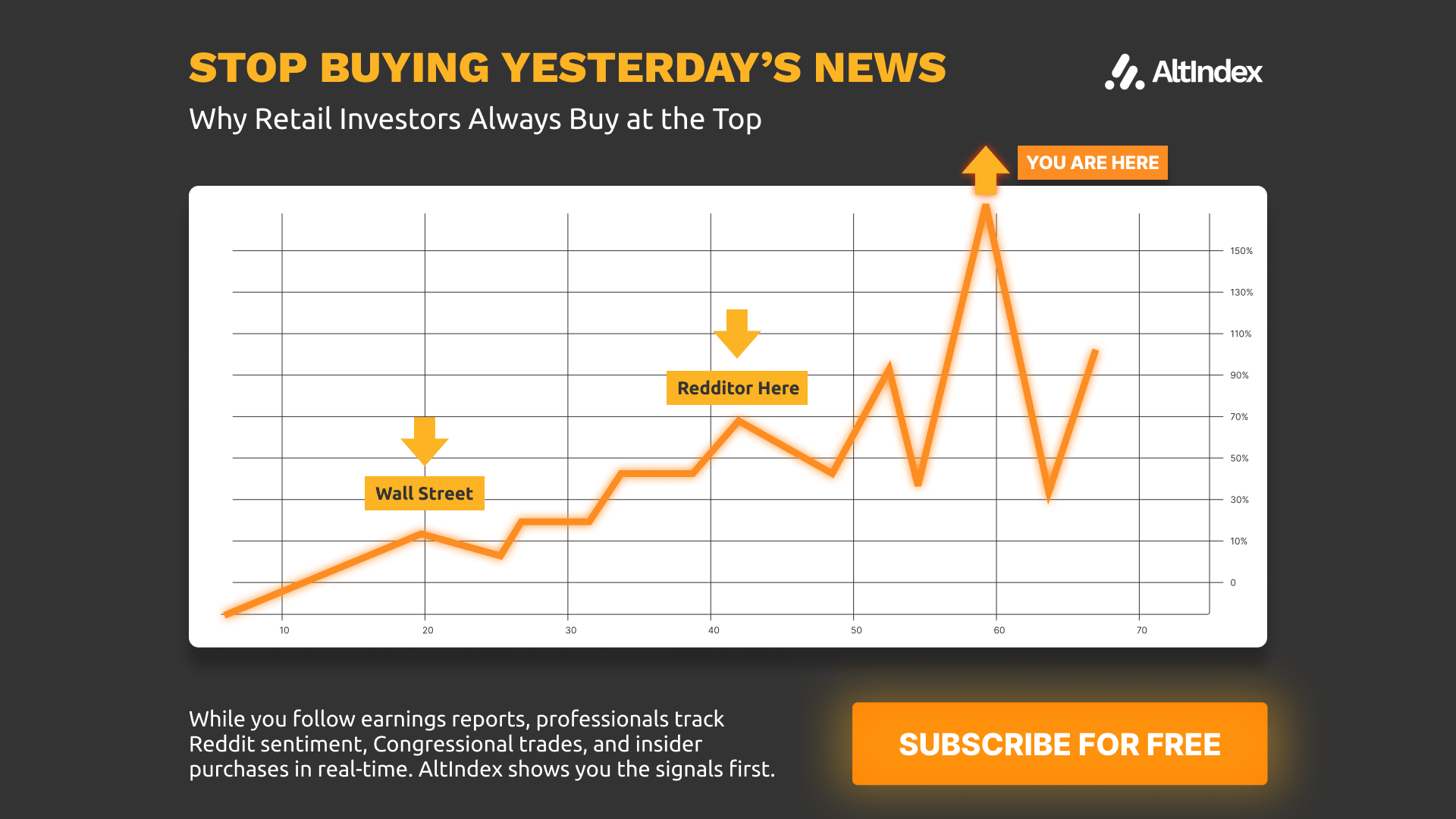

AltIndex’s AI model rated every one of these stocks as a “buy” before it took off.

The kicker? They use alternative data like reddit comments, congress trades, and hiring data.

We’ve teamed up with AltIndex to give our readers free access to their app for a limited time.

The next top performer is already taking shape. Will you be looking at the right data?

Past performance does not guarantee future results. Investing involves risk including possible loss of principal.

⚡ KEY MARKET INSIGHTS FOR JANUARY 7, 2026

• S&P 500 Futures: $6,982.75 (slight pullback from record highs)

• Bitcoin: $92,366 holding above $90K with institutional inflows returning

• WDC (Western Digital): BEST S&P 500 STOCK YTD +16.9% on memory chip surge

• ADP Employment: +41K (below 50K est) - softer jobs data supports Fed rate cuts

• VTYX: +55% after hours on $1B+ Eli Lilly acquisition talks

• Supreme Court tariff decision expected Friday - major market catalyst

�� MARKET OVERVIEW: RECORDS AMID ROTATION

Markets are experiencing a powerful momentum shift as we enter the first full trading week of 2026. The Dow Jones achieved its BEST START TO A YEAR THIS CENTURY, posting a remarkable +2.91% gain through just three trading days. The S&P 500 and Dow both hit fresh all-time highs Tuesday, signaling robust investor confidence despite lingering macro uncertainties.

Key Technical Levels: S&P 500 futures are trading at $6,982.75 with critical support at 6,973 and resistance at 6,989-7,000. A breakout above 7,000 would trigger algorithmic buying and potentially push toward 7,006 and beyond.

�� HOTTEST SECTORS & MONEY ROTATION

BULLISH SECTORS ��

• Memory/Storage (WDC, MU, SNDK): Memory chip prices surging 30-35% Q1 2026. WDC leading S&P 500 YTD with +16.9% gains. NAND flash and DRAM seeing explosive AI-driven demand.

• Bitcoin Treasury Companies (MSTR, APLD): MSTR +4.35% premarket after MSCI confirms no exclusion from indexes. Bitcoin ETF inflows exceed $1B in first two days of 2026.

• Biotech/Pharma M&A (VTYX, GLUE): Acquisition wave accelerating. VTYX +55% on Eli Lilly talks. GLUE +44.78% on positive Phase 1 data for NLRP3 inflammasome treatment.

• Metals & Mining (AEM, CCJ, FCX): BofA top picks for 2026. Gold targeting $5,000/oz, silver $60/oz. Copper at all-time highs on tariff concerns.

• Defense (KBR): Awarded seat on MDA's $151B SHIELD contract - massive long-term revenue catalyst.

• Energy Infrastructure (NNE, VST, VRT, CEG): AI's biggest bottleneck is energy. Compute/cooling sourced in months but power takes years - decade-long tailwinds for power ecosystem.

BEARISH/DECLINING SECTORS ��

• Solar (FSLR): Downgraded to Hold from Buy at Jefferies. Tariff uncertainty weighing on renewables.

• Footwear (DECK): Downgraded to Underweight at Piper Sandler. Consumer discretionary facing headwinds.

• Space/Satellite (ASTS, RKLB): Profit-taking after monster 2025 runs. ASTS -5.58%, RKLB -3.14% premarket.

• Energy (Crude Oil): WTI down 0.5% to $56.85 after Trump Venezuela deal. Bearish for energy equities short-term.

�� HIGH-CONVICTION TRADING OPPORTUNITIES

Trade #1: WDC (Western Digital) - Memory Chip Explosion ��

Price: $214.44 (verified close Jan 6, 2026)

Trade Rating: 9.5/10 ⭐⭐⭐⭐⭐

Catalyst: NAND flash prices projected to surge 30-35% in Q1 2026 (TrendForce). Best S&P 500 performer YTD (+16.9%). Morgan Stanley raised PT to $228, Cantor Fitzgerald to $250. Joined Nasdaq-100 Index Dec 22.

• Entry Zone: $212-$218 (current levels)

• Target 1: $228 (+6.3%) - Morgan Stanley PT

• Target 2: $250 (+16.6%) - Cantor Fitzgerald PT

• Stop Loss: $198 (-7.7%)

• Time Horizon: 2-4 weeks swing trade or 3-6 month position

Trade #2: VTYX (Ventyx Biosciences) - M&A Arbitrage Play ��

Price: $16.34 after-hours (verified Jan 6, 2026), closed at $10.05

Trade Rating: 8.5/10 ⭐⭐⭐⭐

Catalyst: Eli Lilly (LLY) in advanced talks to acquire for $1B+ (WSJ). Deal could be announced imminently. Stock jumped 62.5% after-hours. Developing oral therapies for inflammatory diseases.

• Risk: Deal-dependent play. Entry at current levels carries deal break risk.

• Strategy: Wait for opening print Wednesday. If opens $15-$17, hold for deal announcement. If gaps above $18, take profits.

• Sympathy Plays: Other biotech M&A targets: GLUE (+44.78%), NMRA (+15.38%). Pharma giants (Roche, Novo Nordisk) active in NLRP3 inflammasome space.

Trade #3: MSTR (MicroStrategy/Strategy Inc) - Bitcoin Proxy Bounce ��

Price: $164.72 (verified close Jan 6, 2026)

Trade Rating: 7.5/10 ⭐⭐⭐⭐

Catalyst: MSCI decided NOT to exclude digital asset treasury companies in February 2026 index review. Stock +4.35% premarket. Bitcoin holding above $90K with $1B+ ETF inflows in first 2 days of 2026.

• Entry Zone: $160-$170

• Target 1: $190 (+15.4%)

• Target 2: $220 (+33.6%) if BTC breaks $100K

• Stop Loss: $148 (-10.1%)

• Risk Note: Down 66% from ATH. $17.4B unrealized loss in Q4 2025. High volatility stock.

• Position Size: Small speculative position only (2-5% of portfolio)

₿ BITCOIN & CRYPTOCURRENCY OUTLOOK

Bitcoin Price Action

Current Price: $92,366 (verified Jan 7, 2026 7:21 AM IST) Key Levels: Support: $88,000-$90,000 | Resistance: $94,645 | Target: $100,000

Bernstein analysts: "We believe with reasonable confidence that bitcoin and broader digital asset markets have bottomed at $80,000 in late November. The 4-year cycle peak concerns are overstated. Institutional demand is driving adoption."

• Bernstein Price Targets: $150,000 in 2026, $200,000 in 2027

• Tom Lee (Fundstrat): Expects new all-time high by end of January 2026

• BofA Gold Forecast: $5,000/oz in 2026 (avg $4,538), Silver $60/oz (+32% YoY)

• Morgan Stanley: Filing for spot Ethereum ETF - major institutional adoption signal

Crypto Market Breadth

• Ethereum (ETH): $3,221.93 (+0.24% 24h). Outperforming BTC on weekly/monthly frames. Up 9% since Jan 1.

• XRP: $2.25 (-5.06% 24h). Led large caps with +29% weekly gain before pullback. Rejected at $2.40.

• Solana (SOL): $138.02 (+0.26% 24h). Up 12% over past week. Strong fundamentals continue.

• Market Sentiment: Fear & Greed Index at 42 (Fear zone). Bitcoin dominance below 59% signals potential alt season if conditions stabilize.

• Top Crypto Trade: Monitor BTC $94,645 resistance breakout for entry into alts. Rising open interest without panic liquidations = healthy consolidation.

�� ECONOMIC CALENDAR & CATALYSTS

Wednesday, January 7, 2026 - TODAY

• 8:15 AM ET - ADP Employment Report: ACTUAL: +41K (Est: +50K, Previous: -32K revised). BEARISH for employment, BULLISH for rate cuts.

• 10:00 AM ET - ISM Non-Manufacturing PMI (Dec): Expected to show services sector strength. Critical for GDP outlook.

• 10:00 AM ET - JOLTS Job Openings (Nov): Expected decline for first time in 4 months. Would support Fed rate cut thesis.

• 10:30 AM ET - EIA Crude Oil Inventories: Watch for Venezuela deal impact.

• 4:10 PM ET - FOMC Member Bowman Speaks: Hawkish Fed governor - watch for rate cut pushback.

Friday, January 9, 2026 - MAJOR CATALYST

Supreme Court Tariff Decision: Court expected to rule on legality of Trump's emergency tariffs imposed under IEEPA. Could force government to refund billions, create doubts about preliminary trade deals, renew deficit concerns. Major volatility catalyst. TD Cowen: If struck down, White House could recreate tariffs using 1974 balance-of-payments authority or 1930 Tariff Act (up to 50% on imports from discriminating countries).

Week of January 13-17, 2026

• CPI Inflation Data: Critical for Fed rate cut path. Truflation at 5-month low.

• Earnings Season Kickoff: Major financials report. JPM, C, WFC, BAC start week.

• Fed Chair Decision: Trump expected to unveil Fed chair choice. Powell term ends February 2026.

���� TRUMP MOMENTUM TRADES & POLITICAL CATALYSTS

White House Impact on Markets

Venezuela Oil Deal: Trump announced Venezuela will relinquish 50 million barrels of crude to US (valued at $2.8B). "This Oil will be sold at its Market Price, and that money will be controlled by me." US attempting to seize Venezuela-linked tanker in Atlantic. Sanctions will be rolled back. BEARISH for oil prices (WTI -0.5%), NEUTRAL to BULLISH for equities (reduces inflation pressure).

Greenland Expansion: Kalshi markets price 37% chance Trump will buy at least part of Greenland. White House exploring options on national security grounds. European allies pushed back. NATO concerns rising. NEUTRAL market impact short-term, geopolitical risk long-term.

Tariff Supreme Court Case: Arguments heard Nov 5, 2025. Decision imminent (possibly Friday). Challenge to Trump's use of emergency powers for tariffs. Learning Resources and V.O.S. Selections brought cases. HIGH VOLATILITY CATALYST.

Trump-Linked Trading Opportunities

• Defense Contractors (RTX, LMT, NOC, GD, KBR): Venezuela military action bullish. KBR won $151B SHIELD contract seat.

• Energy Independence (XLE, OXY, DVN, FANG): Venezuela deal increases US oil supply. Short-term bearish, long-term bullish for US production dominance.

• Metals/Mining (FCX, GOLD, NEM): Greenland has massive rare earth deposits. Exploratory plays if acquisition progresses.

• Infrastructure (CAT, DE, VMC, MLM): Trump fiscal stimulus tailwinds. BofA notes productivity gains multi-decade theme.

• Social Media (TRUTH Social via DWAC, RUM +4.17%): Trump media ecosystem benefiting from conservative platform growth. Rumble trending.

Key Trading Community Signals

• Memory Chip Euphoria: Mike Zaccardi (CFA, CMT): "WDC best S&P stock YTD +16.9%". SNDK (SanDisk spinoff) +27.56% trending #1. Community extremely bullish on memory sector.

• Bitcoin Bottom Call: BACH: "Heavy liquidation clusters above $95K. Downside bids/liquidations stack around $89K-$91K." Institutional sentiment turning bullish with ETF inflows.

• Biotech M&A Wave: Palmer: "VTYX 10.05 up 6.50 Eli Lilly in advanced talks." "GLUE 16.01 up 5 positive Phase 1 data." Big pharma hunting for pipeline assets.

• Metals Mania: Mike Zaccardi: "BofA 2026E gold price target $5,000/oz; price to average $4,538/oz, +32% YoY. Silver averaging $60/oz in 2026E." Gold currently $4,453.

• Tesla Caution: Palmer: "TSLA 432.96 flat. Elon Musk touted Roadster demo. Safety is NOT the priority. I'll be trading puts again today." Bearish sentiment on TSLA.

• Discord IPO: Chat platform filed confidentially for IPO. Gaming/social media sector watch.

• Gap Play Watchlist: Greg McGauley: "CDIO, MNTS, CRML, MBLY, GME" - momentum scanners targeting these for intraday volatility.

Community Sentiment Summary

Overwhelmingly bullish on: Memory/storage, metals/mining, defense, biotech M&A, Bitcoin bounce, AI infrastructure. Bearish on: TSLA short-term, solar/renewables, consumer discretionary, overextended space stocks. Key Theme: Rotation from Big Tech into AI infrastructure, memory, energy, metals. "Pick and shovel" plays outperforming.

�� WEDNESDAY TRADING GAMEPLAN

Market Open Strategy (9:30 AM ET)

1. Watch WDC opening print: If gaps above $220, take profits on overnight positions. If opens $212-$218, add to longs targeting $228-$250.

2. VTYX acquisition arbitrage: If opens $15-$17, hold for deal announcement. Above $18, scale out. Below $14, avoid entry (deal risk).

3. ES futures: Support 6,973. Resistance 6,989. Breakout above 7,000 = add SPY/QQQ long exposure. Break below 6,970 = reduce exposure.

4. Bitcoin: $94,645 resistance key. Breakout triggers alt season. Below $90K requires defensive position sizing.

5. Volatility watch: VIX at 12.1 (9-day) extremely low. Complacency reading. Position for potential Friday tariff volatility spike.

10:00 AM ET - Economic Data Reactions

• ISM Services > 55: Bullish for equities, bearish for bonds. Reduces rate cut odds.

• ISM Services < 50: Bearish for equities, bullish for bonds/gold. Increases recession fears.

• JOLTS decline: Bullish for rate cut trade. Buy TLT, defensive sectors.

• JOLTS increase: Bearish for bonds, neutral for equities. Labor market still tight.

Risk Management Rules

• Position Sizing: Core positions (WDC, MU): 15-20% allocation. Speculative (MSTR, VTYX): 2-5% max. Crypto: 10-15% total.

• Stop Loss Discipline: Use hard stops 7-10% below entry. Friday tariff decision = wildcard. Consider reducing positions Thursday EOD.

• Profit Taking: Scale out at targets. WDC: 50% at $228, 25% at $240, 25% at $250. Lock gains before major catalysts.

• Volatility Protection: Consider VIX calls or SPY puts as hedge for Friday. Cheap insurance with VIX at 12.1.

�� SECTOR ROTATION & MONEY FLOW SUMMARY

Money Moving INTO:

• Memory/Storage (WDC, MU, SNDK): Massive institutional flows on AI demand, supply constraints. 30-35% price increases Q1.

• Precious Metals (GOLD, AEM, NEM): Gold up 67% in 2025 to $4,453. BofA targets $5,000. Safe-haven flows accelerating.

• Industrial Metals (FCX, SCCO): Copper all-time highs. Trump tariffs pulling inventory into US. Supply concerns.

• Defense (RTX, LMT, KBR): Venezuela action catalyst. $151B SHIELD contract for KBR. Geopolitical tensions rising.

• Energy Infrastructure (VST, CEG, NNE): Nvidia CEO: Energy is AI's biggest bottleneck. Decade-long tailwinds.

Money Moving OUT OF:

• Mega-Cap Tech (AAPL, GOOGL, META): Profit-taking after 2025 gains. Rotation into AI infrastructure picks.

• Consumer Discretionary (DECK, NKE): Downgrades on demand concerns. Consumers feeling economic pressure.

• Solar/Renewables (FSLR, ENPH): Tariff uncertainty. Policy headwinds under Trump.

• Overextended Space Stocks (ASTS, RKLB): Profit-taking after 300%+ 2025 gains. Still long-term bullish but near-term consolidation.

�� FINAL THOUGHTS & COMMUNITY

The market is sending clear signals: Rotation is underway from mega-cap tech into AI infrastructure, memory, metals, and energy. The Dow's best start to a year this century combined with record highs in S&P 500 confirms institutional confidence. However, Friday's Supreme Court tariff decision introduces significant tail risk.

Key Execution Points:

• Focus on memory/storage sector (WDC, MU, SNDK) - clearest trend with fundamental backing

• Bitcoin consolidation above $90K is constructive - watch for $94,645 breakout

• Reduce leverage ahead of Friday's tariff ruling - volatility spike likely

• Softer employment data (ADP +41K vs 50K est) supports Fed rate cut thesis - bullish medium-term

• M&A wave accelerating in biotech - watch for sympathy plays on deal announcements

Join the Community: This analysis is powered by the daily insights and real-time scanning of our DCG Command Center trading community. We trade together, learn together, and win together. For structured education on these strategies, visit aitradingskool.com to elevate your trading game.

Trade smart. Risk less. Profit consistently.

DISCLAIMER

This newsletter is for informational and educational purposes only. All trading ideas, price targets, and market analysis are based on publicly available information and represent opinions, not financial advice. Trading stocks, options, futures, and cryptocurrencies involves substantial risk of loss and is not suitable for every investor. Past performance is not indicative of future results. All prices mentioned are verified as of market close January 6, 2026, or premarket January 7, 2026, unless otherwise stated. Markets are volatile and conditions change rapidly. Always conduct your own due diligence and consult with a licensed financial advisor before making investment decisions. DCG Command Center, its contributors, and affiliated entities may hold positions in securities discussed. This newsletter does not guarantee profits and readers are responsible for their own trading decisions and outcomes.

© 2026 DCG Command Center | All Rights Reserved

Reply