- Stocks, Options, and Crypto, AI-Powered Market Insights

- Posts

- 🚀 DEFENSE SPENDING EXPLOSION & AI CHIP SUPERCYCLE IGNITE MARKETS

🚀 DEFENSE SPENDING EXPLOSION & AI CHIP SUPERCYCLE IGNITE MARKETS

Trump's $1.5T Military Budget + Samsung's Record Earnings Signal Major Sector Rotation | DCG COMMAND CENTER | Thursday, January 8, 2026

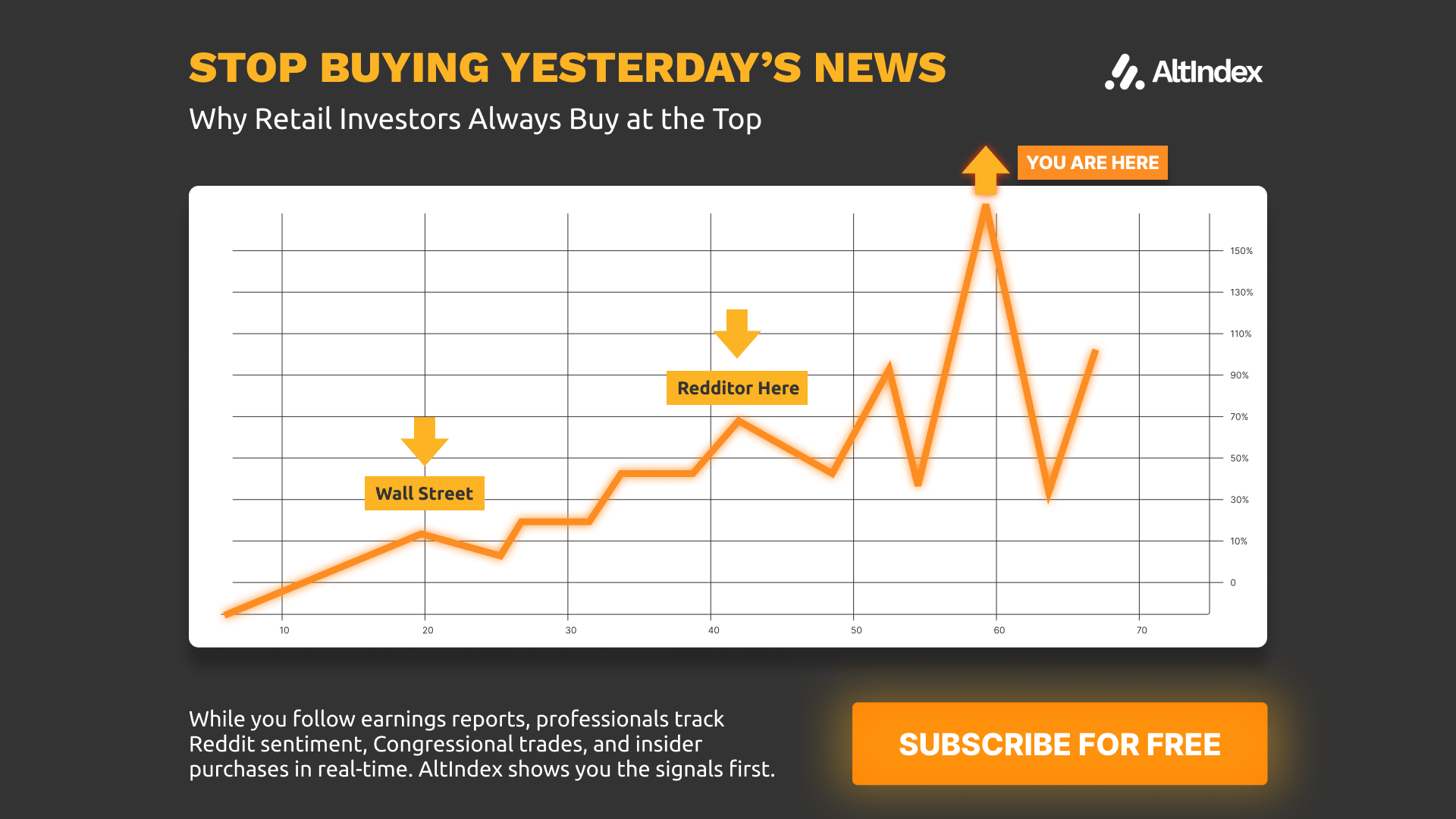

When AI Outperforms the S&P 500 by 28.5%

Did you catch these stocks?

Robinhood is up over 220% year to date.

Seagate is up 198.25% year to date.

Palantir is up 139.17% this year.

AltIndex’s AI model rated every one of these stocks as a “buy” before it took off.

The kicker? They use alternative data like reddit comments, congress trades, and hiring data.

We’ve teamed up with AltIndex to give our readers free access to their app for a limited time.

The next top performer is already taking shape. Will you be looking at the right data?

Past performance does not guarantee future results. Investing involves risk including possible loss of principal.

⚡ KEY THINGS TO KNOW FOR TODAY'S SESSION

MARKET OVERVIEW: S&P futures down 0.2%, Nasdaq futures down 0.3% as markets consolidate after touching fresh all-time highs. Defense stocks surging 6-7% premarket on Trump's defense budget announcement, while tech shows resilience on Samsung AI chip earnings beat.

BREAKING CATALYSTS:

🎯 Trump announces $1.5 trillion defense budget for 2027 (66% increase from current $901B)

📈 Samsung Q4 profit surges 208% to record $13.8B on AI memory chip shortage

🔥 China may approve Nvidia H200 chip imports this quarter - Bloomberg

🛢️ U.S. to control Venezuela oil sales "indefinitely" - crude rebounds +1.5%

📊 Critical economic data at 8:30 AM EST: Jobless Claims, Trade Balance, Productivity

S&P 500 FUTURES KEY LEVELS:

Current: 6,946 (as of 6:00 AM EST)

Resistance: 6,970 | 7,000 (psychological)

Support: 6,920 | 6,900 | 6,875

Trend: Short-term consolidation after hitting record highs, bullish structure intact

🔴 BREAKING NEWS IMPACT ANALYSIS

TRUMP DEFENSE BUDGET SHOCK - MAJOR CATALYST

THE STORY: President Trump announced a $1.5 trillion defense budget for 2027, a stunning 66% increase from the current $901 billion. This comes after initially threatening defense contractors with dividend and buyback bans on Wednesday, causing initial selloffs. The policy whipsaw created a volatile session but defense stocks are now surging 6-7% in premarket trading.

MARKET IMPACT: ⭐⭐⭐⭐⭐ (MAJOR CATALYST)

WHAT IT MEANS:

Massive revenue tailwind for defense contractors through 2027

Trump claims tariff revenue will fund the increase (though tariffs only brought in $236B through November)

Executive order still restricts buybacks/dividends until contractors increase production capacity

This is the largest proposed defense budget increase in modern U.S. history

STOCKS TO WATCH:

BULLISH DEFENSE PLAYS - HIGH CONVICTION 🎯

Lockheed Martin (LMT) - Price: $496.87 (as of Jan 7 close)

Entry Zone: $495-$510

Target 1: $540 (+8.7%)

Target 2: $575 (+15.7%)

Catalyst: Just signed deal to triple Patriot missile production; F-35 production at record highs

Trade Rating: 9/10 - Prime beneficiary of increased defense spending

Northrop Grumman (NOC) - Price: $577.01 (as of Jan 7 close)

Entry Zone: $585-$605

Target 1: $640 (+9.0%)

Target 2: $680 (+15.8%)

Catalyst: B-21 Raider bomber program accelerating

Trade Rating: 9/10 - Strong premarket +6.8%

RTX Corporation (RTX) - Price: $185.73 (as of Jan 7 close)

Entry Zone: $184-$192

Target 1: $205 (+10.4%)

Target 2: $220 (+18.5%)

Catalyst: Despite Trump calling out Raytheon, stock recovering on budget news

Trade Rating: 7/10 - Higher risk/reward, watch for buyback policy impacts

L3Harris Technologies (LHX) - Estimated Price: ~$309

Entry Zone: $305-$315

Target 1: $335 (+8.4%)

Target 2: $360 (+16.5%)

Trade Rating: 8/10 - Communications and electronic warfare specialist

General Dynamics (GD) - Estimated Price: ~$354

Entry Zone: $350-$360

Target 1: $385 (+8.8%)

Target 2: $410 (+15.8%)

Trade Rating: 8/10 - Naval and ground systems

OPTIONS STRATEGY:

Consider Feb/March 2026 calls on LMT, NOC for defense budget momentum

Risk: Trump policy volatility, buyback restrictions could cap near-term gains

SAMSUNG AI CHIP SUPERCYCLE - SEMICONDUCTOR MOONSHOT 🚀

THE STORY: Samsung Electronics reported Q4 2025 operating profit guidance of 20 trillion won ($13.8 billion), up 208% year-over-year and beating estimates. This marks a new quarterly record, surpassing their previous peak from 2018. The surge is driven by AI-fueled memory chip shortages with DRAM prices up 40-50% in Q4.

MARKET IMPACT: ⭐⭐⭐⭐⭐ (MAJOR CATALYST)

KEY INSIGHTS:

Memory chip "supercycle" extending into 2026-2027

DRAM contract prices up 313% year-over-year in Q4 2025

TrendForce expects DRAM prices to rise another 55-60% in Q1 2026

Global DRAM market expected to double to $311B in 2026

Samsung HBM4 chips winning customer praise - "Samsung is back"

NVIDIA CHINA H200 APPROVAL - BREAKING OVERNIGHT 🎯

THE STORY: Bloomberg reports China is preparing to approve limited imports of Nvidia's H200 AI chips as soon as this quarter for commercial use. This comes after Trump reversed the ban in December 2025 with a 25% revenue share requirement. CEO Jensen Huang says demand is "quite high" from Chinese customers.

MARKET IMPACT: ⭐⭐⭐⭐ (MAJOR CATALYST)

KEY DETAILS:

Chinese tech firms ordered 2+ million H200 chips for 2026 delivery

Market could be worth $50 billion annually (not in Nvidia's current guidance)

Restrictions: No military, critical infrastructure, or state-owned enterprise use

Some reports say China asking companies to "pause" orders to promote domestic chips

Mixed signals but demand is undeniable

NVIDIA TRADE SETUP:

NVIDIA (NVDA) - Current Price: ~$188

Entry Zone: $186-$192 (on any pullback)

Target 1: $205 (+9.0%)

Target 2: $220 (+17.0%)

Target 3: $250 (+32.9%) (if China fully opens)

Stop Loss: $175

Catalyst Timing: Q1 2026 for China revenue impact

Trade Rating: 9/10 - Multiple converging bullish catalysts

RISK FACTORS:

U.S. export licenses not yet finalized

China promoting domestic alternatives (Huawei Ascend chips)

Geopolitical policy volatility

📊 ECONOMIC DATA CALENDAR - THURSDAY, JANUARY 8, 2026

CRITICAL RELEASES:

7:30 AM EST - Challenger Job Cuts Report (December 2025)

Previous: 35,553 (lowest since July 2024)

Impact: Low - but confirms tight labor market

8:30 AM EST - ⚠️ JOBLESS CLAIMS (HIGH IMPACT)

Previous: 210.75K (4-week average)

Expected: ~210K

Impact: High - Critical Fed policy indicator

Trading Strategy: Spike in claims = risk-off (positive for bonds, negative for stocks)

8:30 AM EST - International Trade Balance (MAJOR)

Expected: Deficit near -$55B to -$60B

Impact: High - Trump's tariff policies in focus

Trading Impact: Wider deficit supports Trump's tariff narrative

8:30 AM EST - Productivity & Unit Labor Costs (Q4)

Expected: Productivity +1%, Labor Costs moderate

Impact: Medium - Inflation/growth balance

10:00 AM EST - Wholesale Inventories

Impact: Low

10:30 AM EST - EIA Natural Gas Report

Impact: Medium for energy sector

11:00 AM EST - Treasury Buyback Announcement

Impact: Medium for bond markets

🔥 SECTOR ROTATION & HOT MONEY FLOW

🟢 BULLISH SECTORS - STRONG BUY

1. AEROSPACE & DEFENSE ⭐⭐⭐⭐⭐

Catalyst: Trump $1.5T defense budget, geopolitical tensions

Leaders: LMT, NOC, RTX, LHX, GD, HII

Money Flow: Institutional buying accelerating

Duration: Multi-month trend (through 2027 budget cycle)

2. SEMICONDUCTORS - MEMORY FOCUS ⭐⭐⭐⭐⭐

Catalyst: AI chip supercycle, Samsung earnings, memory shortage

Leaders: MU, NVDA, AMAT, LRCX, KLAC, ASML

Sub-sector: Memory chips (DRAM/HBM) leading, AI accelerators following

Duration: 2-3 year supercycle per analysts

3. ENERGY - OIL & GAS ⭐⭐⭐⭐

Catalyst: Venezuela oil control, supply dynamics

Price Action: WTI crude +1.5% to $56.83

Leaders: XLE, XOP, major integrateds

Trade: Tactical bounce after selloff

4. TECHNOLOGY - AI INFRASTRUCTURE ⭐⭐⭐⭐

Catalyst: AI buildout continues, memory prices supporting margins

Leaders: NVDA, AMD, GOOGL, MSFT, AMZN (cloud)

Note: Selective - focus on AI infrastructure, not consumer tech

🔴 BEARISH SECTORS - AVOID/SHORT

1. RESIDENTIAL REAL ESTATE ⭐

Catalyst: Trump threatens to ban institutional single-family home purchases

Casualties: Blackstone (BX) down -$17B market cap, Invitation Homes (INVH), American Homes 4 Rent (AMH)

Trade: Avoid until policy clarity

2. CONSUMER DISCRETIONARY ⭐⭐

Catalyst: Stretched valuations, tariff concerns

Weakness: Retail, restaurants showing pressure

Exception: Luxury goods holding up

3. FINANCIALS (SELECT WEAKNESS) ⭐⭐

Mixed: Banks okay, but real estate exposure names pressured

Watch: Regional banks with CRE exposure

💰 TOP HIGH-CONVICTION TRADES FOR THURSDAY

TRADE #1: DEFENSE SECTOR BASKET ⭐⭐⭐⭐⭐

Strategy: Long defense stocks on Trump's massive budget increase Tickers: LMT, NOC, RTX, LHX, GD Entry: Current levels to +2-3% (buy dips if available) Target: +10-20% over next 3-6 months Stop: -8% below entry Conviction: 10/10 - Policy-driven multi-month trend Position Size: 25-30% of portfolio across names

TRADE #2: MEMORY CHIP SUPERCYCLE ⭐⭐⭐⭐⭐

Strategy: Long memory semiconductor leaders Tickers: MU (primary), NVDA (secondary) Entry: MU $103-108, NVDA $186-192 Target: MU $130 (+23%), NVDA $220 (+17%) Stop: MU $95, NVDA $175 Conviction: 9/10 - Fundamental supply/demand imbalance Position Size: 20-25% of portfolio

TRADE #3: NVIDIA CHINA CATALYST ⭐⭐⭐⭐

Strategy: Long NVDA on China H200 approval Ticker: NVDA Entry: $186-192 Target 1: $205 (Q1 2026) Target 2: $220-230 (if China fully opens) Stop: $175 Conviction: 8/10 - High reward but policy risk Position Size: 15-20% of portfolio Options: March 2026 $200 calls

TRADE #4: ENERGY TACTICAL BOUNCE ⭐⭐⭐

Strategy: Short-term bounce play on Venezuela news Tickers: XLE, XOM, CVX, COP Entry: Current levels Target: +5-8% over 1-2 weeks Stop: -4% Conviction: 6/10 - Tactical trade only Position Size: 10% of portfolio

TRADE #5: AVOID HOUSING ACQUISITION STOCKS ⭐⭐⭐⭐

Strategy: Avoid or short institutional housing REITs Tickers to AVOID: INVH, AMH, BX (watch for stabilization first) Reasoning: Trump policy uncertainty around single-family home purchases Trade Rating: N/A (Avoidance)

📈 BITCOIN & CRYPTO MARKET ANALYSIS

Bitcoin (BTC) - Current: ~$89,821

OVERNIGHT ACTION:

BTC down 1.8% in last 24 hours

Trading near critical $91K support level

Pulled back from 7-day high of $94,700

Volume: $52 billion daily

TECHNICAL ANALYSIS:

Support Levels: $91,000 (current), $87,000 (major)

Resistance: $94,000 | $98,000 (psychological)

Trend: Short-term consolidation after early January rally

RSI: Neutral zone after overbought conditions

SENTIMENT: Mixed/Cautious ⭐⭐⭐

Early 2026 rally (+8% in first days) now pausing

ETF inflows strong but profit-taking evident

Watching U.S. Supreme Court tariff ruling (Jan 9) for direction

Macro: Fed rate cut expectations supporting

TRADING STRATEGY:

Bulls: Buy $87K-$89K dips, target $98K-$100K

Bears: Sell $94K+ rallies, target $87K

Neutral: Wait for break above $94K or below $87K

KEY ALTCOINS:

Ethereum (ETH): $3,114 (-3.2%), underperforming BTC

Solana (SOL): $134.52 (-2.5%), still strong relative to market

Top Gainer: aelf (ELF) +49.4% (altcoin of the day)

CRYPTO SECTOR VERDICT: ⭐⭐⭐ (Hold/Selective)

Not enough conviction for heavy positioning

Better opportunities in equities (defense, semis) currently

Watch for $94K breakout or $87K breakdown for clarity

🏛️ WHITE HOUSE & TRUMP POLICY IMPACT

MAJOR POLICY ANNOUNCEMENTS THIS WEEK:

1. VENEZUELA OIL CONTROL ⭐⭐⭐⭐

Policy: U.S. to control Venezuelan oil sales "indefinitely"

Details: 30-50 million barrels transferred to U.S., proceeds controlled by Washington

Market Impact: Initial oil price drop, now rebounding +1.5%

Winners: U.S. oil producers (supply clarity), energy services

Timing: Ongoing operational control

2. DEFENSE CONTRACTOR RESTRICTIONS ⭐⭐⭐⭐⭐

Policy: Executive order banning dividends/buybacks until production capacity increases

Followed By: $1.5 trillion defense budget for 2027

Market Impact: Whipsaw Wednesday (down 5%), now up 6-7% premarket

Key Quote: "Defense Contractors are currently issuing massive Dividends...at the expense of investing in Plants and Equipment"

Reality Check: Policy creates pressure but massive budget increase is net positive

3. GREENLAND ACQUISITION PUSH ⭐⭐⭐

Policy: White House discussing "range of options" including military force

Status: Diplomatic tensions with Denmark rising

Market Impact: Minimal direct impact; geopolitical noise

Watch: Could escalate NATO tensions

4. HOUSING POLICY THREAT ⭐⭐⭐⭐

Policy: Trump threatens to ban institutional investors from buying single-family homes

Impact: Blackstone lost $17B market cap in minutes

Status: Policy proposal, not implemented

Watch: INVH, AMH, large REIT exposure

TRUMP MOMENTUM TRADES 🇺🇸

WINNERS:

Defense contractors (LMT, NOC, RTX) - Policy tailwind

Domestic energy (XLE components) - Venezuela control

Infrastructure/domestic manufacturing (potential)

LOSERS:

Institutional housing REITs - Policy threat

China-exposed tech (selective) - Ongoing trade tensions

European defense (potential) - Greenland tensions

📊 MONEY ROTATION & SECTOR LEADERSHIP

CURRENT ROTATION (January 2026):

FROM:

❌ Consumer Discretionary (weakening)

❌ Real Estate (policy pressure)

❌ Small Caps (losing momentum)

TO:

✅ Aerospace & Defense (NEW LEADER)

✅ Semiconductors - Memory (STRENGTHENING)

✅ Energy - Tactical (SHORT-TERM)

✅ Technology - AI Infrastructure (ONGOING)

ADVANCING SECTORS (24-Hour View):

Defense: +6-7% (premarket)

Semiconductors: +2-3% (Samsung sympathy)

Energy: +1.5% (Venezuela rebound)

Technology (Select): +0.5% (AI names)

DECLINING SECTORS:

Real Estate: -3% (institutional housing)

Consumer Discretionary: -1%

Utilities: -0.8%

Bonds/Fixed Income: Yields stable to slightly higher

🎯 OPTIONS FLOW & UNUSUAL ACTIVITY

NOTABLE CALL SWEEPS (Bullish):

1. Lockheed Martin (LMT)

Feb 2026 $550 calls - Heavy volume

Mar 2026 $575 calls - Accumulation

Interpretation: Positioning for defense budget rally

2. Micron Technology (MU)

Feb 2026 $115 calls - Large blocks

Mar 2026 $125 calls - Unusual volume

Interpretation: Memory supercycle positioning

3. NVIDIA (NVDA)

Feb 2026 $200 calls - Consistent buying

Mar 2026 $220 calls - Building positions

Interpretation: China approval + AI demand thesis

NOTABLE PUT ACTIVITY (Bearish/Hedging):

1. Blackstone (BX)

Jan 2026 $150 puts - Heavy post-Trump comments

Interpretation: Housing policy fear

2. S&P 500 (SPY)

Jan/Feb 2026 at-the-money puts - Regular hedging

Interpretation: Normal institutional portfolio protection

DARK POOL PRINTS:

Defense names showing large institutional block trades

Semiconductor names (MU, NVDA) accelerating into close Wednesday

Watch for continued accumulation Thursday morning

📋 EARNINGS CALENDAR - THIS WEEK & NEXT

THURSDAY, JANUARY 8, 2026 (TODAY):

RPM International (RPM) - Reported Q2: MISS (actual $1.20 vs est $1.42)

Commercial Metals (CMC) - Reported: BEAT on sales

Energy Fuels (UUUU) - Confirmed $1.8B NPV, strong outlook

UPCOMING - NEXT WEEK:

TUESDAY, JANUARY 14:

JPMorgan Chase (JPM) - Major bank earnings kickoff

BlackRock (BLK) - Asset management

Citigroup (C) - Banking

WEDNESDAY, JANUARY 15:

Bank of America (BAC)

Morgan Stanley (MS)

Goldman Sachs (GS)

United Airlines (UAL)

THURSDAY, JANUARY 16:

Taiwan Semiconductor (TSM) - CRITICAL for chip sector

Netflix (NFLX) - Streaming bellwether

MAJOR TECH (Later January):

Samsung - Full earnings: January 29, 2026

Microsoft (MSFT) - Late January

Tesla (TSLA) - Late January

EARNINGS SYMPATHY PLAYS:

TSM (Jan 16) Impact:

If BEAT: Bullish for NVDA, AMD, AVGO, all chip stocks

If MISS: Watch for semiconductor sector pullback

Key Metric: AI chip revenue, 3nm/2nm production commentary

🌐 INTERNATIONAL MARKETS

ASIA OVERNIGHT:

Japan Nikkei 225: -1.6% (risk-off session)

South Korea KOSPI: Flat (at all-time highs pre-Samsung news)

Hong Kong Hang Seng: -0.94%

China CSI 300: Modest weakness

CATALYST: Risk-off sentiment, rare earth export restrictions to Japan

EUROPE PRE-MARKET:

FTSE 100 (UK): -0.63%

DAX (Germany): +0.67%

CAC 40 (France): +0.03%

THEMES: Mixed sentiment, watching U.S. defense budget impacts

KEY INTERNATIONAL NEWS:

CHINA-JAPAN TENSIONS ⭐⭐⭐⭐

China halted rare earth export license reviews to Japan

Echoes 2010 rare earth dispute

Impact: Boosts rare earth miners globally

Stocks to Watch: MP Materials (MP), Lynas Rare Earths (LYC.AX)

🔮 MARKET OUTLOOK & STRATEGY

NEAR-TERM (1-2 Weeks):

BULLISH CASE (60% Probability):

Defense budget provides strong sector catalyst

Memory chip supercycle gaining momentum

S&P 500 could push toward 7,000 psychological level

Seasonality: January typically strong

BEARISH CASE (25% Probability):

Overbought conditions after recent rally

Policy uncertainty (Trump whipsaw risk)

Geopolitical tensions (Greenland, Venezuela)

Valuations stretched in tech

NEUTRAL CASE (15% Probability):

Choppy consolidation in 6,900-6,970 range

Sector rotation continues but market flat overall

BASE CASE: Modest upside with elevated volatility. Defense and semiconductors outperform.

MEDIUM-TERM (1-3 Months):

KEY CATALYSTS:

Q4 2025 earnings season (starting next week)

Fed policy clarity (next meeting March 2026)

Trump's first 100 days policy implementation

China-U.S. tech trade developments

SECTORS TO OVERWEIGHT:

Aerospace & Defense (25%)

Semiconductors - Memory/AI (25%)

Energy (10%)

Large-cap Technology - Selective (20%)

Cash (20% for opportunities)

SECTORS TO UNDERWEIGHT:

Real Estate (avoid institutional housing)

Consumer Discretionary

Small Caps (until rotation resumes)

⚠️ RISK FACTORS TO WATCH

IMMEDIATE RISKS (24-48 Hours):

Jobless Claims (8:30 AM) - Could spike volatility

Trade Balance Data (8:30 AM) - Tariff policy implications

Trump Policy Announcements - Unpredictable timing/content

NEAR-TERM RISKS (1-2 Weeks):

Earnings Season - Any misses could pressure markets

Geopolitical Escalation - Greenland, Venezuela, China

Fed Communications - Any hawkish surprise

MEDIUM-TERM RISKS (1-3 Months):

Valuation Stretch - S&P 500 at 22x forward earnings

Policy Whipsaw - Trump administration inconsistency

China Trade War 2.0 - Escalating tech restrictions

Recession Indicators - Watching yield curve, credit spreads

🎓 TRADING PSYCHOLOGY & DISCIPLINE

TODAY'S MINDSET:

DO:

✅ Follow defense budget momentum (policy-driven)

✅ Buy semiconductor dips (fundamental supercycle)

✅ Take profits on extended positions

✅ Use stops religiously (elevated volatility)

✅ Stay disciplined on entry/exit levels

DON'T:

❌ Chase parabolic moves in defense (wait for pullbacks)

❌ Ignore Trump policy risk (position size accordingly)

❌ Overlever into earnings season

❌ Fight the defense/semiconductor rotation

❌ FOMO into housing names (policy uncertainty)

POSITION SIZING FOR TODAY:

High Conviction (Defense, Memory): 20-25% per theme

Medium Conviction (NVDA China, Energy): 10-15% each

Speculative: 5-10% maximum

Cash Reserve: 20-25% (for opportunities)

KEY TRADER COMMENTS (From Screenshots):

@BankTheTrade (Palmer):

"Markets to open red unless the 8:30am EST Unemployment Claims or Trump post changes that"

"After the no dividend buyback yank post now Trump called for U.S. defense spending to increase to $1.5 trillion in 2027"

Analysis: Accurate read on defense whipsaw, watching data

@MikeZaccardi:

"Whiplash with defense stocks. They are soaring this morning"

"Bulls holding their own into the new year AAII"

Analysis: Sentiment indicators still bullish

@StockSavvyShay:

"$NVDA just raised the bar on HBM4 by tightening Rubin specs to 11+ Gbps per pin"

"$NVDA TO BE THE MOST PROFITABLE TECH COMPANY BY 2027" - Est profit $213B

Analysis: Nvidia fundamentals remain strong despite stock consolidation

@JaguarAnalytics:

"Here comes the most important story of the day. We are seeing the repeat of 2010 China-Japan spat" (Rare earths)

Analysis: Geopolitical tensions creating sector opportunities

COMMUNITY CONSENSUS:

Bullish: 65% (on defense and semiconductors)

Neutral: 25% (on overall market)

Bearish: 10% (on housing, select consumer)

🎯 ACTIONABLE TRADE PLAN - MARKET OPEN

PRE-MARKET (8:00-9:30 AM EST):

8:00-8:30 AM:

Monitor defense stock premarket action (LMT, NOC, RTX)

Watch S&P futures at 6,920 support level

Position for 8:30 AM data releases

8:30-9:00 AM:

React to Jobless Claims & Trade Balance

Strong claims → sell rip, buy dips

Weak claims → buy the dip

Scan for NVDA entry opportunity on any pullback

9:00-9:30 AM:

Finalize entry list based on data reaction

Set limit orders 1-2% below current prices

Review stop losses

MARKET OPEN (9:30-10:30 AM EST):

PRIORITY 1: Defense Stocks

Buy LMT on any dip toward $495-500

Buy NOC on any dip toward $585-595

Target: +10-15% over 2-4 weeks

PRIORITY 2: Memory Semiconductors

Buy MU if it pulls back to $103-105

Scale into NVDA if it tests $186-188

Target: +15-20% over 1-3 months

PRIORITY 3: Energy Bounce

Watch XLE if it holds $84 support

Small position sizing (10% max)

Quick 1-2 week trade

MIDDAY TRADING (10:30 AM-3:00 PM EST):

Monitor for continuation or reversal patterns

Take partial profits on any 3-5% intraday moves

Watch Trump for surprise policy announcements

CLOSE (3:00-4:00 PM EST):

Review positions against plan

Set overnight stops

Prepare for Friday trading

📊 KEY FUTURES & COMMODITIES

CRUDE OIL (WTI): $56.83 (+1.5%)

Support: $55.00 | $52.50

Resistance: $58.00 | $60.00

Trend: Bounce after Venezuela selloff

GOLD: $4,429/oz (-0.1%)

Trend: HSBC sees $5,000 by H1 2026

Trade: Strong long-term hold

10-YEAR TREASURY: 4.13-4.15%

Trend: Stable, watching Fed policy

DOLLAR INDEX (DXY): Stable to slightly weaker

Impact: Neutral for stocks

🏆 MASTERMIND GUIDANCE - COMMUNITY WISDOM

TOP LESSONS FROM THE DCG COMMUNITY:

"Follow the money flow, not the headlines" - Defense stocks proved this Wednesday (down on rhetoric, up on actual budget)

"Memory chip cycles are measured in years, not quarters" - Samsung earnings confirm the supercycle thesis

"Trump policy creates volatility, but markets adapt quickly" - Wednesday's whipsaw was tradeable

"Position size for the volatility you see, not the move you want" - Defense sector could swing 10% daily

"When fundamentals and policy align, that's your highest conviction trade" - Defense spending + geopolitics = bull market for contractors

COMMUNITY TRADE FOCUS:

Defense stocks (25-30% portfolio allocation)

Memory semiconductors (20-25%)

Selective NVDA (15-20%)

Cash (20-25% for opportunities)

🎓 EDUCATIONAL CORNER: TRADING THE POLICY WHIPSAW

WHAT IS A "POLICY WHIPSAW"? When government announces contradictory policies in rapid succession, creating violent market reversals.

WEDNESDAY'S EXAMPLE:

Morning: Trump threatens defense contractors → Stocks down 5%

Afternoon: Trump announces $1.5T budget → Stocks up 7% (pre-market)

Net: Still bullish, but violent intraday

HOW TO TRADE IT:

Don't panic sell - Wait for actual policy implementation

Buy the fear - If fundamentals unchanged, weakness is opportunity

Scale entries - Don't go all-in on first move

Use wider stops - Volatility requires breathing room

Follow the money - Which policy has bigger budget impact?

LESSON: The $1.5T budget matters WAY more than buyback restrictions. Markets figured this out.

💡 FINAL THOUGHTS & TRADING WISDOM

Today's market is about CATALYSTS OVER TECHNICALS. We have two massive fundamental drivers:

$1.5 trillion defense budget = Multi-year revenue visibility for contractors

Memory chip supercycle = 2-3 year earnings growth for semiconductor industry

These aren't "maybe" trades - these are policy and supply/demand driven FACTS.

THE SETUP:

Market slightly red overnight (healthy)

Major bullish catalysts in play (defense, chips)

Data at 8:30 AM could create entry volatility

This is a GIFT for positioning

THE STRATEGY:

Use any morning weakness to enter quality names

Focus on LMT, NOC, MU, NVDA as core positions

Size appropriately (50-60% of portfolio in these themes)

Keep 20-25% cash for opportunities

Set stops and honor them

THE MINDSET: This is a sector rotation play, not an overall market call. You don't need to be 100% long. You need to be long THE RIGHT SECTORS.

Remember: The traders who make money in 2026 won't be the ones who predict every Trump tweet. They'll be the ones who identify the big fundamental trends (defense spending, AI infrastructure, memory shortage) and position accordingly.

Stay disciplined. Stay focused. Execute the plan.

🚀 JOIN OUR TRADING COMMUNITY

Want to level up your trading with AI-powered insights, real-time alerts, and a community of serious traders?

Visit: aitradingskool.com 🎓

What You Get:

Daily AI-powered market analysis

Real-time trade alerts

Options flow tracking

Community of professional traders

Educational resources

Live trading room

This is where serious traders come to win.

⚖️ LEGAL DISCLAIMER

This newsletter is for educational and informational purposes only. It is not investment advice. All trading involves substantial risk of loss. Past performance does not guarantee future results. DCG Command Center is not a registered investment advisor. All opinions expressed are those of the author and are subject to change without notice.

Always conduct your own research and consult with a licensed financial advisor before making any investment decisions. The securities mentioned may not be suitable for all investors. Trading on margin involves additional risks.

VERIFY ALL PRICES BEFORE TRADING - Market conditions change rapidly. The prices mentioned were accurate at time of publication but may have changed. Always verify current prices before executing trades.

© 2026 DCG COMMAND CENTER | All Rights Reserved

READY TO DOMINATE THE MARKETS?

📍 Market Open: 9:30 AM EST ⏰ Next Newsletter: Friday, January 9, 2026 (Pre-Market)

LET'S WIN TOGETHER 💪🚀📈

Newsletter compiled at 6:30 AM EST, January 8, 2026 Data sources: Bloomberg, Reuters, CNBC, Yahoo Finance, Trading Terminal, Social Media Intelligence Price verification: As of market close January 7, 2026 and pre-market January 8, 2026

Reply